With an abundance of natural resources and commodities like copper, gold, and silver amongst Latin America countries, it is no surprise that many of the mega projects (costing $1 billion USD or more) in the region are mining projects.

Aside from mineral wealth, there are also major infrastructure and energy projects underway in LatAm. These major projects aim to make LatAm countries safer, establish more solar energy, and improve connectivity and mobility, including the decommissioning of potentially dangerous dams in Brazil and expanding Mexico’s Felipe Ángeles International Airport.

Here are 6 Latin American mega projects currently underway in planning or construction phases:

1. Peripheral Ring Road (Anillo Vial Periférico) Project – Lima, Peru (Infrastructure)

The Periférico Ring Road project (also known as the “Anillo Vial Periférico”) aims to implement a 34.8-kilometer highway in Lima, Peru, from Óvalo 200 miles to Avenida Circunvalación.

This $2.05 billion USD megaproject is co-financed by private sector initiatives, and is expected to take 30 years to complete. The infrastructure project will impact 11 districts of the metropolitan city of Lima, as well as the seaside city of Callao.

The mega project is being overseen by the Ministry of Transport and Communications and the Metropolitan Municipality of Lima. The Peripheral Ring Road project is in the planning phase, and it is estimated that the megaproject’s construction on the northern periphery will begin in 2023.

2. Pascua-Lama – Chile / Argentina (Mining)

Courtesy of Barrick Gold

Pascua Lama is a gold, silver and copper mine in the Andes Mountains bordering Chile and Argentina. The $8.5 billion USD open-pit mine is operated by Barrick Gold Corporation, and while the Pascua part of the project closed in September 2020, the Lama project on the Argentinian side has confirmed an extensive gold copper mineralized system in the stratigraphically important area between the Pascua-Lama deposit and their Penelope porphyry target near Veladero.

Barrick is also evaluating the possibility of heap leaching ore from the Penelope deposit of Lama in Argentina at Veladero, according to their Q2 2021 report. It has the potential production of 775,000 ounces of gold per year, along with silver and copper byproducts, over a 25-year mine life.

3. Dos Bocas Refinery – Mexico (Energy)

Photo courtesy of The Office of Presidente de México Andrés Manuel López Obrador.

Currently under-construction, the Dos Bocas oil refinery in Tabasco, Mexico, will be capable of refining 340,000 barrels per day (bpd). It will also be capable of producing 170,000 bpd of petrol and 120,000 bpd of ultra-low sulphur diesel, making it the biggest refinery in Mexico once complete. The colossal project was part of Mexico’s National Refining Plan of December 2018, and aims to help the country reach energy independence. Petroleos Mexicanos (Pemex) is Mexico’s state-run oil company.

The engineering and construction work for the refinery is divided into six work packages:

- Work package 1: ICA Fluor (a joint venture between the Mexican EPC company ICA and US-based EPC firm Fluor).

- Work package 2 & 3: Samsung Engineering and Mexico-based Asociados Constructores DBMR.

- Work package 4 & 6: KBR and Mexico-based Constructora Hostotipaquillo. Additionally, Mexicana de Recipientes a Presión is assisting with metallic structures. It is reported that KBR left the project in September 2020 over costs going severely over original estimations.

- Work package 5: Canada’s Keller and Mexico-based firm Menard.

State-owned Pemex began construction of Dos Bocas in June 2019, and it was originally estimated to be a 3-year, $7.6 billion USD project, though Pemex’s 2020 annual report noted that the mega project could ultimately cost $12.4 billion USD and that the original timeframe of opening in 2022 will be pushed to at least 2023.

4. Yanacocha Sulfides – Peru (Mining)

Newmont’s $2.1 billion USD Yanacocha Sulfides mega project in northern Peru is in the decision-making process. At this vast gold mine, Newmont plans to develop the first phase of sulfide deposits and an integrated processing circuit, including an autoclave to process gold, copper and silver feedstock.

Construction is expected to take approximately two and a half years, after which the project would begin operating in 2026. Newmont reports that this project “would add 500,000 gold equivalent ounces per year to the mine production with all-in sustaining costs between $700 to $800 per ounce for the first five full years of operations”.

5. Marcobre’s Mina Justa Project – Marcona, Peru (Mining)

The Mina Justa project is a $1.6 billion USD open-pit copper mining mega project near Marcona, Peru. The copper project is a joint venture between Minsur and Alxar, and is being overseen by Marcobre SAC. Marcobre SAC is owned by Cumbres Andinas SAC, which has as shareholders Minsur SA (holds 60% of shares) and Alxar Internacional SpA (holds the remaining 40% of shares).

Construction began in August 2018, and when the project is complete it is expected to process 12 million tons of oxide ore and 6 million tons of sulphide ore annually, as well as produce up to 149,000 tons of copper concentrates and 58,000 tons of copper cathode over 16 years of mine life.

Ausenco is the engineering, procurement, construction, and management (EPCM) contractor for the Mina Justa copper project. Marcobre is the owner company of the Mina Justa (meaning “Fair Mine”) project; it is their goal to generate a positive impact and sustainable development in the local and national economy based on its corporate values, respect for the community, environmental care and being a benchmark in social management.

6. T-MEC Corridor – Mexico (Infrastructure)

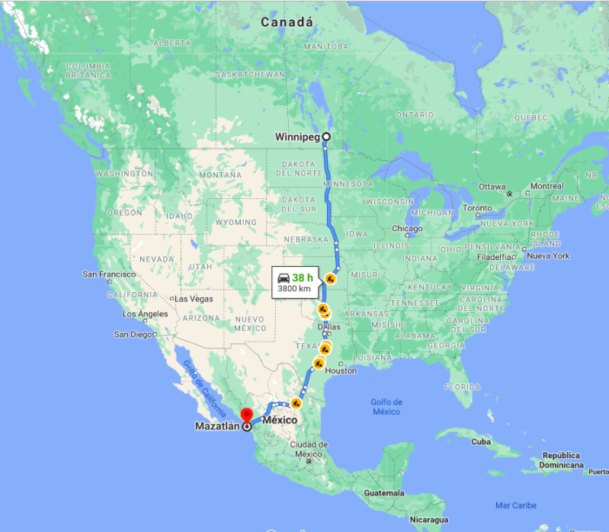

The T-MEC Corridor is a $3.3 billion USD megaproject that is meant to facilitate the trade of goods between Mexico, the United States, and Canada.

The private-sector initiative is led by investment firms National Standard Finance and Caxxor Group. Once complete, the mega project will create a rail and maritime link between Mazatlán city in the Sinaloa state of Mexico, and Winnipeg, Canada, by crossing the United States. T-MEC Corridor route plans include the Port of Mazatlán with Durango, MX; Monterrey, MX; Dallas, TX; Tulsa, OK; and Chicago, IL, before ending in Winnipeg, Canada.

According to Carlos Ortiz, Caxxor Group’s CEO, planning and negotiations with the three governments have already begun, and the firms expect to complete a new port in Mazatlán by 2024 as part of stage one.

A $1B USD new port in Mazatlan, MX, is expected to have a great impact on the area as a new sea terminal. Alongside the port, the project allocations consist of $400M USD for a new logistics center in Winnipeg, CAN, the $300M USD construction of a new shipyard, $600M USD for 87 kilometers of roads, and $1B USD for constructing a logistics park.

ARES PRISM project controls software is utilized by many of the world’s leading mining organizations to help deliver their projects on-time and within budget. It is also trusted on many massive infrastructure and energy projects around the globe to help project organizations deliver projects on-time and within budget, while also acting as an early warning signal for risks.

ARES PRISM’s enterprise capabilities allow for conducting quick what-if analysis so that project organizations can easily prioritize or de-prioritize their projects, or even stop projects as necessary based on feasibility studies. It provides a means for accurate forecasting, managing contingency and improving project standardization.

Learn more about how the mining, infrastructure and energy industries utilize ARES PRISM for cost management and more.